New Issue Workflow

Overview

Objective

By being one of the top investment banks in the world, this institution was seeking to increase new issues participation in the financial market. This bank reached out to us to redesign and automate a big portion of the new issue workflow in order to speed up this time-sensitive process, reduce human error, and offer its employees a better, smarter system that could offer all the relevant information and functionality they need to perform successfully.

Problem

The bank’s current platform for managing new issues has many gaps and manual processes along the workflow, causing significant delays and frustration to users. The main problem consists of the usage of different tools designed for each role, which do not speak to each other, causing users to navigate to many pages and input the same data many times in these different sites.

My Involvement

I was in this engagement for 7 months. I was the lead (and only) designer in the team, working along with a Product Owner and a Lead Developer in NY, and 2 other developers in Noida, India. I worked very closely with the client’s UX team based in London, as well as with their lead developers.

Users

Traders

Traders are in charge of looking for new issues announced in the market. They are responsible for communicating the issues’ details to the Portfolio Managers so they can determine which issues are suitable for their strategies. Traders handle most of the ground work (entering the data into the system, communicating with the underwriters, updating details as issue changes during the day, etc.)

Portfolio Managers

Portfolio Managers are the decision makers. They decide which accounts they want to allocate to a new issue, and how to effectively distribute their available cash among different potential issues. In order for them to make rational decisions, they need great market knowledge . They interact with the research analysts, who provide deeper, analytical information on the issuers and current market trends, as well as investment recommendations.

Research Analysts

Research Analysts are responsible for providing latest market information and accurate issuer details to Portfolio Managers. They document the data in many formats: data visualizations, Excel, free text recommendations.

User Journey

Sketches

By confirming the User Journey and pain-points with users, I created an initial workflow with sketches. These sketches focus on the main pain-points mentioned by users in their interviews and by observing their behavior while using their application.

Wireframes

Traders: Add New Issue

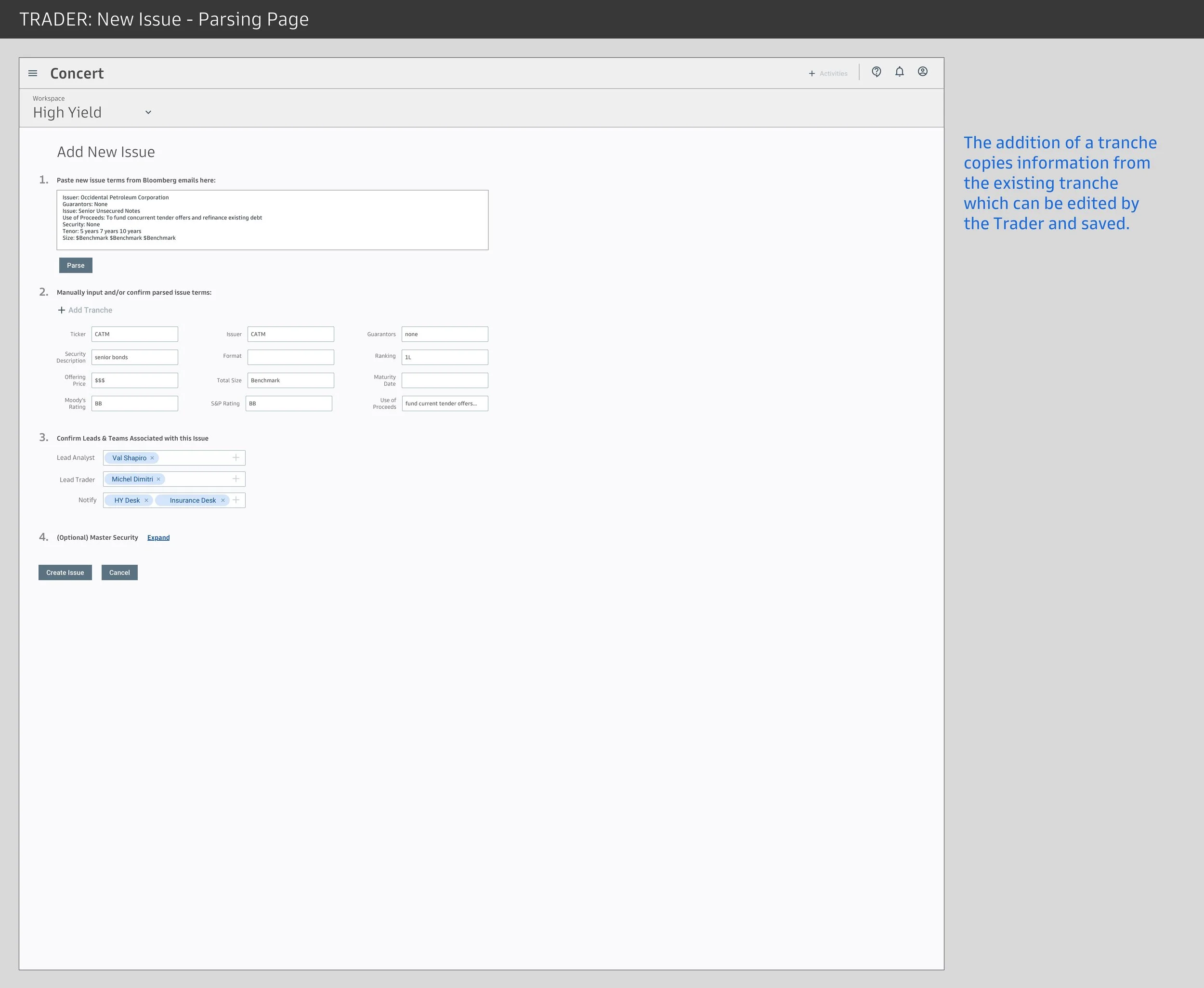

Step 1: Parsing

Instead of traders communicating the issue information via chat to PMs, Traders can simply enter it directly in the system by copy-pasting the information obtained from the market platforms. The new application can parse the text and automatically fill in the required fields to add a new issue to the platform. This can reduce the risk of entering wrong data and can fasten the process of inputting data.

Step 2: Confirm Parsed Information

Parsing functionality can make mistakes in some cases. Users has the ability to edit and confirm the fields as they wish.

Step 3: Determining Team for Issue

Once the trader has entered all the information, the system can determine the appropriate Research Analyst (based on the Ticker data in the application) and potential PMs interested in this issue (determined by desk). Similarly to Step 2, traders can modify these fields if needed. This step will automatically notify the corresponding parties about the issue creation, which will reduce back and forward communication between Traders and PMs.

Portfolio Managers: Review and Allocate Accounts

Step 1: Receive Notification

The notification as mentioned above is created once the trader adds the new issue to the calendar. PMs can quickly access the information by clicking on the notification

Step 2: Digest Issue Information

Once PMs click on the notification, they enter a view where all the necessary information is available to make a decision on investing. This information includes the Traders’ issue details added previously as well as Research data specifically for this issuer provided by the Research Analyst. This will prevent all users from navigating from one space to the other, allowing them to draw a full picture of the issue without switching context.

Step 3: Allocate Accounts (assuming PM is interested in the issue)

PMs can quickly search for their accounts, add the necessary details to complete the allocation process and submit it to compliance automatically. This was deprioritized by stakeholders, given that the “Product Mastering” step is a requirement in order for PMs to allocate. This step will be performed in a later stage of the issue.